How does Habitat for Humanity work?

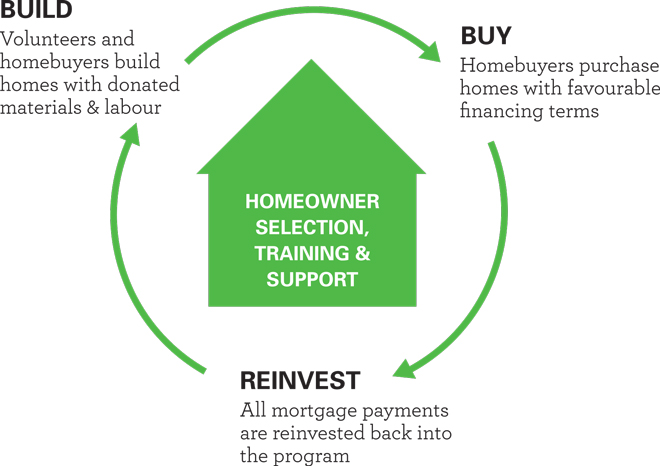

Founded in 1998, Habitat for Humanity Cornwall & The Counties services the area of Stormont, Dundas and Glengarry including Cornwall and Cornwall Island. We are working towards a world where everyone has a safe and decent place to live. Our mission is to mobilize volunteers and community partners in building affordable housing and promoting homeownership as a means to breaking the cycle of poverty. Once completed, Habitat homes are appraised and sold to families at fair market value with a no down payment, no interest mortgage, held by Habitat and amortized for a suitable amount of time. The homeowners’ monthly mortgage payments go into a revolving fund, which is used to build more local homes

How are the homes built?

Habitat for Humanity Cornwall & The Counties buiilds safe, decent, affordable homes.

Most Habitat for Humanity projects are single dwellings or semi-detached homes, but Habitat for Humanity is expanding its build projects and may include restoration and refurbishments, condominiums and town home style projects in the future.

Who qualifies for a home?

The three criteria to qualify for a Habitat for Humanity home are:

- A need for affordable housing.

- An ability to repay a Habitat for Humanity mortgage.

- A willingness to partner with Habitat for Humanity.

The need for affordable housing is defined by a family income that is below the government-set Low Income Measure for the region, and existing living conditions that are inadequate in terms of structure, cost, safety or size. The ratio of shelter expense to total income is also factored.

Ability to repay a Habitat for Humanity mortgage requires that the family has a stable income sufficient to cover the monthly mortgage payments and other expenses that come with home ownership.

Homeowners must demonstrate a willingness to partner with Habitat for Humanity by contributing 500 hours of volunteer labor towards the building of their home.

How are the homes funded?

Habitat for Humanity builds homes with volunteer labour and as much donated or cost-reduced material as possible. Fundraising takes place to help offset expenses of materials, services and land when they are not available through donations. Financial support is received from individuals, corporations, service groups and the faith community.

Mortgage payments from current homeowners are retained by the affiliate, which holds the mortgages, to fund future projects.

How is this a hand up, not a hand out?

Habitat for Humanity houses are sold to families, not given to them free of charge. In addition, families help to build their own home.

By building homes at low cost, requiring very little or no down payment, and not charging interest on the mortgage, Habitat for Humanity is able to provide an opportunity, or a “hand up”, to buy a home for families that would not otherwise qualify for a conventional mortgage.

The revolving Fund for Humanity

The homeowners’ monthly mortgage payments go into a fund that is used to build more homes. The more homes that exist, the more cash flow there is available for further building. This “revolving fund for humanity” fuels exponential growth in the number of houses that are built over time.

Our mission is to provide affordable home ownership opportunities to local, working, low-income families to help build strength, stability and self-reliance.